Equities Find Some Stability

8 October 2021

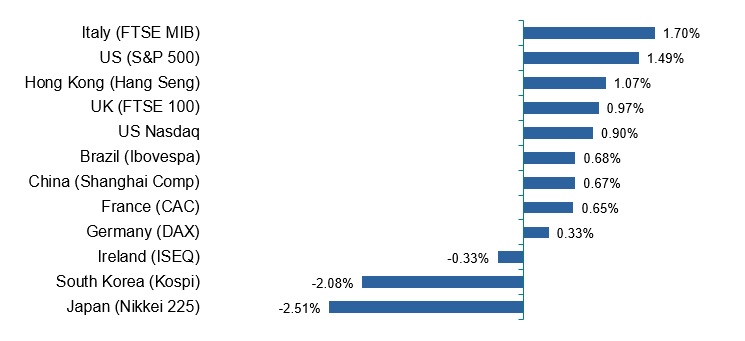

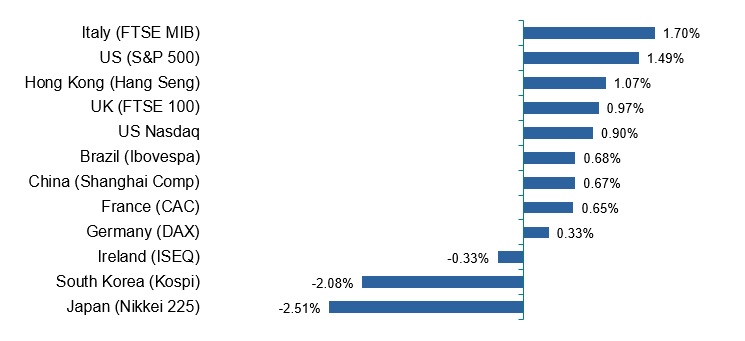

In a better week for risk assets, many of the world’s leading stock markets stopped the recent rot to post positive returns. Investor sentiment was lifted by the agreement of Congress to raise the debt ceiling and avoid the risk of default, while some easing of pressure on natural gas prices in Europe late in the week also bolstered confidence levels. However, Friday brought disappointment in the form of a weak US jobs report – while the outcome wasn’t perceived by markets as being sufficiently below par to knock the US Federal Reserve off its expected path of beginning to reduce its bond purchases as early as November, it added a touch of uncertainty to the day’s trading. The upshot of this was a continued sell-off of US Treasuries, with the 10-year yield touching 1.61% - its highest level in four months.

Ireland in the News

One of the relatively poorer stock market performers in the week was located in Dublin as the ISEQ index recorded a modestly negative return of -0.3%. It was a busy week for Irish-related newsflow, not least of which was the government announcement it was ending its long-standing 12.5% corporate tax rate. Ireland is to support an OECD proposal for a global minimum tax rate of 15% for large companies, a move the Department of Finance reckons could reduce tax take by about €2 billion.

More positively, the latest purchasing managers’ indices (PMI) compiled by IHS Markit and AIB revealed that the Irish services sector continued to show strong growth. The Services PMI reading of 63.7 for September remained well about the 50 level that marks the divide between growth and contraction. Meanwhile, Ireland’s unemployment rate fell to 6.4% in September, although the COVID-adjusted rate stands at 10% when those still in receipt of COVID-related benefits are taken into account. Still, the 10% figure is the lowest since the onset of the pandemic, having hit almost 30% during the initial lockdown. In addition, the housing situation showed signs of improvement with Department of Housing figures indicating the total number of new units started in the year to August was almost 30,000.

US Jobs Disappoint

The US nonfarm payroll added 194,000 jobs in September, well below consensus expectations of about 500,000. This represents the lowest monthly gain this year and follows a big miss in the previous month as well. The Fed has stated that the employment situation is a key factor in when it will decide to ease monetary policy, but the market does not expect this report to change the likely start date of a reduction in bond buying. And there were positives in the report – the unemployment rate fell from 5.2% to 4.8% and vacancy levels remain quite high. Companies are hoping that jobseekers will re-emerge as average hourly earnings have increased, pandemic unemployment benefits are ending and as COVID-19 concerns ease.

Energy Prices Remain High

Natural gas prices hit a new high this week as worries about a potential energy crunch amid low reserves continued to unsettle investors. Some modest relief was seen after Russian President Putin indicated a willingness to export increased volumes to continental Europe, although the reported offer attracted some scepticism. Meanwhile, coal prices hit record highs as countries ramp up purchases to ensure sufficient supplies for power stations over the winter. Crude oil prices have also continued to move higher, with Brent crude up another 4% in the week to trade above $82 per barrel. With US gasoline prices at a seven-year high, speculation mounted that the government might release some oil from its strategic petroleum reserve.

Rounding Up

While the US Senate passed a bill to increase the debt ceiling by $480 billion, this is estimated to only last until early December. The Republicans have said they will not support a further increase at that point, meaning there are two months to find an alternative approach.

Government bonds were weaker in most places. German 10-year yields rose to -0.15% from -0.22%, with Irish 10-year yields 6 basis points higher at 0.21%. In the US, 10-year Treasury yields climbed to 1.61% from 1.46% in the week, while similar-dated UK Gilt yields rose from 1.01% to 1.16%. Bond yields rise as bond prices fall and vice-versa.

Source: All information is from Bloomberg Finance LP as at Friday 8 October 2021 unless otherwise noted and has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. This information should not be considered a recommendation to invest in a particular security or to buy or sell any security shown. It is not known whether the securities shown will be profitable in the future.

A Week on the Markets

Source: Bloomberg Finance LP. Capital returns in local currency for the week to Friday 8 October 2021.

Past performance is not a guarantee of future results. Index returns are unmanaged and do not reflect the deduction of any fees or expenses.

Ireland in the News

One of the relatively poorer stock market performers in the week was located in Dublin as the ISEQ index recorded a modestly negative return of -0.3%. It was a busy week for Irish-related newsflow, not least of which was the government announcement it was ending its long-standing 12.5% corporate tax rate. Ireland is to support an OECD proposal for a global minimum tax rate of 15% for large companies, a move the Department of Finance reckons could reduce tax take by about €2 billion.

More positively, the latest purchasing managers’ indices (PMI) compiled by IHS Markit and AIB revealed that the Irish services sector continued to show strong growth. The Services PMI reading of 63.7 for September remained well about the 50 level that marks the divide between growth and contraction. Meanwhile, Ireland’s unemployment rate fell to 6.4% in September, although the COVID-adjusted rate stands at 10% when those still in receipt of COVID-related benefits are taken into account. Still, the 10% figure is the lowest since the onset of the pandemic, having hit almost 30% during the initial lockdown. In addition, the housing situation showed signs of improvement with Department of Housing figures indicating the total number of new units started in the year to August was almost 30,000.

US Jobs Disappoint

The US nonfarm payroll added 194,000 jobs in September, well below consensus expectations of about 500,000. This represents the lowest monthly gain this year and follows a big miss in the previous month as well. The Fed has stated that the employment situation is a key factor in when it will decide to ease monetary policy, but the market does not expect this report to change the likely start date of a reduction in bond buying. And there were positives in the report – the unemployment rate fell from 5.2% to 4.8% and vacancy levels remain quite high. Companies are hoping that jobseekers will re-emerge as average hourly earnings have increased, pandemic unemployment benefits are ending and as COVID-19 concerns ease.

Energy Prices Remain High

Natural gas prices hit a new high this week as worries about a potential energy crunch amid low reserves continued to unsettle investors. Some modest relief was seen after Russian President Putin indicated a willingness to export increased volumes to continental Europe, although the reported offer attracted some scepticism. Meanwhile, coal prices hit record highs as countries ramp up purchases to ensure sufficient supplies for power stations over the winter. Crude oil prices have also continued to move higher, with Brent crude up another 4% in the week to trade above $82 per barrel. With US gasoline prices at a seven-year high, speculation mounted that the government might release some oil from its strategic petroleum reserve.

Rounding Up

While the US Senate passed a bill to increase the debt ceiling by $480 billion, this is estimated to only last until early December. The Republicans have said they will not support a further increase at that point, meaning there are two months to find an alternative approach.

Government bonds were weaker in most places. German 10-year yields rose to -0.15% from -0.22%, with Irish 10-year yields 6 basis points higher at 0.21%. In the US, 10-year Treasury yields climbed to 1.61% from 1.46% in the week, while similar-dated UK Gilt yields rose from 1.01% to 1.16%. Bond yields rise as bond prices fall and vice-versa.

Source: All information is from Bloomberg Finance LP as at Friday 8 October 2021 unless otherwise noted and has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. This information should not be considered a recommendation to invest in a particular security or to buy or sell any security shown. It is not known whether the securities shown will be profitable in the future.

A Week on the Markets

Source: Bloomberg Finance LP. Capital returns in local currency for the week to Friday 8 October 2021.

Past performance is not a guarantee of future results. Index returns are unmanaged and do not reflect the deduction of any fees or expenses.