Maecenas faucibus condimentum ex. Praesent commodo est ut leo uscipit, sed pellentesque tortor efficitur. Nulla nec odio nec nulla ultrices euismod. Suspendisse congue ante sed augue porta finibus.

Ut nisi felis, viverra id congue sit amet, porta at mi. Vestibulum quis mauris lorem. Donec et sapien in ipsum consectetur vehicula a et mi.

Pellentesque vitae felis non nulla condimentum pellentesque non id dolor. Nunc hen drerit cursus nisi sed fringilla. Nunc mattis vehicula porta. Integer tellus elit, ullamcor per ac nulla id, facilisis euismod tortor. Fusce pharetra, risus et rutrum ullamcorper, ante massa gravida dolor, pretium tincidunt nulla nibh non tellus.

Etiam nulla metus, venenatis ornare blandit a, fermentum sed ipsum:

- Maecenas faucibus condimentum ex

- Praesent commodo est ut leo suscipit, sed pellentesque tortor efficitur

- Aliquam iaculis elit vitae lorem tempor, sit amet aliquet

- Maecenas faucibus condimentum ex

Register Now

*Lorem ipsum dolor sit amet disclaimer text here. Vivamus ac elementum augue. Donec pellen tesque nulla vitae libero molestie vehicula.

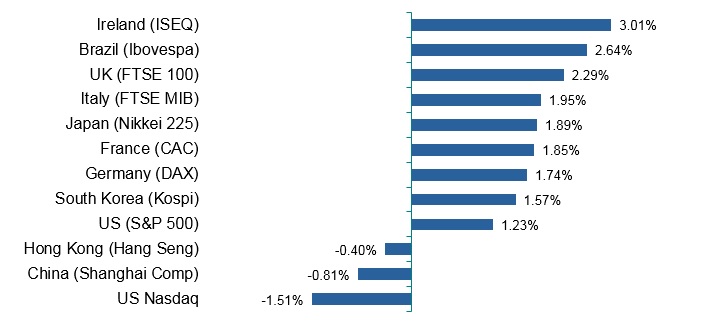

Equities Regain Momentum

7 May 2021The US S&P 500 ended the week at yet another new high, although its gain of 1.2% was at the lower end of market performances. The economic data flow was broadly supportive as evidence continued to show recovery from the COVID crisis. That said, Friday’s US nonfarm payroll stunned the market as the number of new jobs in April came in massively lower than consensus expectations – however, the stock market reaction was ultimately positive as investors appeared to take comfort from the report on the basis the economy was not yet at risk of overheating and the Federal Reserve may not feel compelled to take action anytime soon. There was some rotation out of technology stocks in the week, with the tech-heavy Nasdaq index a major laggard in the week as it fell -1.5%. The best stock market performances were typically found outside the US, with Ireland’s ISEQ index among the top performers.

Jobs, Jobs… Jobs?

Thursday brought the latest US weekly jobless claims data, which came in below 500,000 for the first time since the onset of the pandemic. As a result, the following day’s labour market report for April blindsided the market in terms of how weak it was. Consensus expectations were for the nonfarm payroll to increase by about one million jobs, but the actual gain was just 266,000 – furthermore, revisions to the previous two months’ numbers resulted in a net 78,000 reduction. The unemployment rate also ticked up to 6.1% from 6.0%. Some observers suggested that supply rather than demand might be the issue as some people may not be ready to re-enter the workforce, due to childcare or other factors. The number of people on payrolls is still about eight million less than in February last year.

Economic Activity Continues to be Upbeat

Although the European economy has lagged the US and UK on the vaccinations front, it is accelerating the rollout of inoculations, with more than a quarter of adults reported to have had at least one dose. Moreover, economic data is continuing to reveal an upbeat message. The latest purchasing managers’ indices (PMI) from IHS Markit were notably robust, with manufacturing and services activity continuing to recover. After seven consecutive months of readings below 50, the eurozone services PMI came in at 50.5 for April – readings above 50 are indicative of growth. The manufacturing PMI hit a record high reading of 62.9 with factories ramping up activity as easing COVID restrictions spurred expectations around demand. In Ireland, the manufacturing PMI hit a record high of 60.8, while the services PMI accelerated to 57.3 in April.

Similar reports were released in the US, although the Institute for Supply Management’s (ISM) manufacturing index reading of 60.1 was the lowest since January and well below expectations. The services index also fell short of forecasts, but at 62.7 – down from a record high of 63.7 in March – this is still indicative of a strong rate of expansion.

Signs of improving demand were evident in the latest retail sales data for the euro area, which rose 2.7% in March, month-on-month, with Germany recording a 7.7% gain. Meanwhile, retail sales in France were down -1%, showing that restrictions in individual countries are having a big impact of numbers. Overall, eurozone sales were up by 12% from the same month a year ago – such year-on-year comparisons were always likely to be flattering, but the outcome comfortably topped consensus expectations.

COVID Waiver Suggestion Hits Pharma Stocks

Calls for a temporary patent waiver on COVID-19 vaccines received unexpected support from the US government as efforts are being made to boost production. Companies involved in creating the vaccines saw their share prices hit at the prospect of sharing their intellectual property, with management arguing that manufacturing bottlenecks and shortages of materials were the primary constraints on ramping up production. Pfizer had earlier in the week said it expected $26bn of vaccine-related revenues this year, accounting for about a third of its expected total revenues. Germany came out against the waiver suggestion, stating that it could deter companies’ future investment in research if they are not allowed the rewards of their successful treatments.

Eurozone Bonds

In broad terms, core eurozone bonds outperformed peripherals in the week, with German 10-year Bund yields falling from -0.20% to -0.22%. Similar-dated Italian yields rose from 0.87% to 0.92%, while Irish bond yields increased from 0.19% to 0.22%.

Source: All information is from Bloomberg Finance LP as at Friday 7 May 2021 unless otherwise noted and has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. This information should not be considered a recommendation to invest in a particular security or to buy or sell any security shown. It is not known whether the securities shown will be profitable in the future.

A Week on the Markets

Source: Bloomberg Finance LP. Capital returns in local currency for the week to Friday 7 May 2021.

Past performance is not a guarantee of future results. Index returns are unmanaged and do not reflect the deduction of any fees or expenses.

Register Now

*Lorem ipsum dolor sit amet disclaimer text here. Vivamus ac elementum augue. Donec pellen tesque nulla vitae libero molestie vehicula.

Agenda

| 11.45 | Registration |

| 12.00 | Presentations |

| 13.30 | Close |

Date

Lorem ipsum dolor sit amet

Zunfthaus zur Waag

Münsterhof 8

8001 Zurich

Agenda

| 11.45 | Registration |

| 12.00 | Presentations |

| 13.30 | Close |

Date

Lorem ipsum dolor sit amet

Zunfthaus zur Waag

Münsterhof 8

8001 Zurich

Speakers

|

Name Name Name

Senior Multi-Asset Strategist, State Street Global Markets |

|

Name Name Name

Senior Multi-Asset Strategist, State Street Global Markets |

|

Name Name Name Senior Multi-Asset Strategist, State Street Global Markets |

Speakers

|

Name Name Name

Senior Multi-Asset Strategist, State Street Global Markets |

|

Name Name Name

Senior Multi-Asset Strategist, State Street Global Markets |

Speakers

Senior Multi-Asset Strategist,

State Street Global Markets

Senior Multi-Asset Strategist,

State Street Global Markets

Senior Multi-Asset Strategist,

State Street Global Markets